Financial independence platform early access

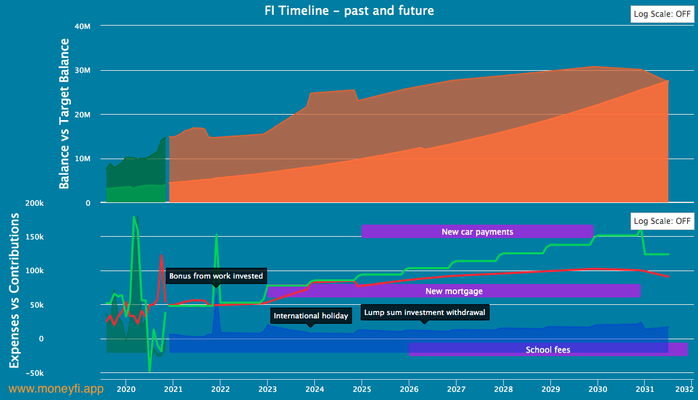

Money FI provides the ability to map out your journey to financial independence while taking into account future life events.

Simply using 25x your annual expenses as a rough guide for determining if you've reached financial independence is a good starting point. But how long will it take to reach that point if your finances are constantly changing over time?

Manual calculations and spreadsheets can only take you so far. Money FI aims to take you the rest of the way.

Table of contents

Determining when we'll reach financial independence - the current state of affairs

Whether we're targeting 25x, 30x or more of our annual expenses as a goal post for having reached financial independence, it's still incredibly difficult to determine when we'll actually get there.

If our lives were set in stone, then extrapolating our expenses and savings rate forward to determine when we'll reach FI is fairly simple. The problem with this back of the napkin approach is that we're not taking into account all the changes to our interests, obligations and finances that are inevitably going to happen as we make our way to FI.

Depending on what stage of life you're currently in, you're likely to any number of large changes to your finances in the future:

- Having kids and all the expenses that come with that (medical, school, clothes etc)

- Buying a house (mortgage payments, insurance etc)

- Buying a car (repayments, insurance etc)

- Holidays (travel costs, accommodation etc)

- Dropping down to part time work to pursue other interests

Our lives aren't set in stone, and neither is our financial independence timeline. Simply taking a snap shot of our lives as they currently are and using that to calculate when we'll reach FI and how much we'll need isn't much better than guess work.

A platform that removes that guess work

The Money FI platform helps you plan your journey to financial independence while taking into account future life events, changes to your finances, inflation and anything else life throws at you.

The platform consists of two components. Firstly you're able to track your income, expenses and investments over time. Analytics are available which help you slice, dice, categorize and tag your data to uncover trends and insights within your financial habits.

Secondly, the above data is used to track your historical progress to financial independence as well as projecting your future timeline. You're able to enter life events (such as the examples given above) along with their associated impact to your expenses, income and investments. These are then incorporated into your timeline calculation.

Your FI timeline is computed by taking into account future life events (once off and recurring), inflation, changes to your savings rate and several other configurable data points.

Getting early access to Money FI

The Money FI platform is currently in early access beta. This is a time period where users have the opportunity to take the platform through its paces while checking for bugs and highlighting possible additional features.

If you're interested in getting an early look at Money FI and are willing to provide feedback on your experience, head over here to sign up.

Money FI has been built from the ground up for the financial independence community to remove a lot of the guess work, manual calculations and spreadsheets that we all typically start out with. Most importantly, Money FI gives you the ability to plan for future life events and their resulting impact on your FI timeline.

Article by Brendon @ Money FI