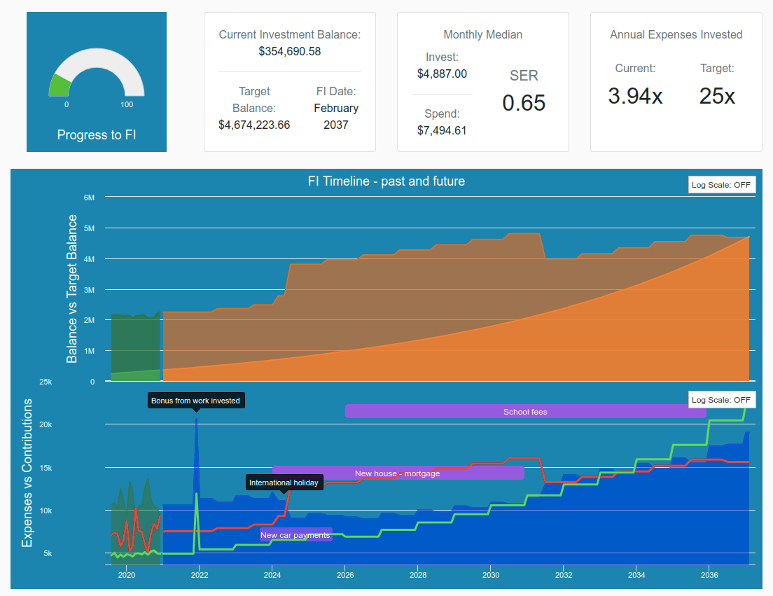

Financial Independence Planning

Create an accurate FI plan that takes into account future life events and changes to your finances over time.

Plan for the future

Our interests, obligations and financial commitments change over time.

Creating a FI plan by only taking into account your current expenses isn't good enough.

Get answers to questions like:

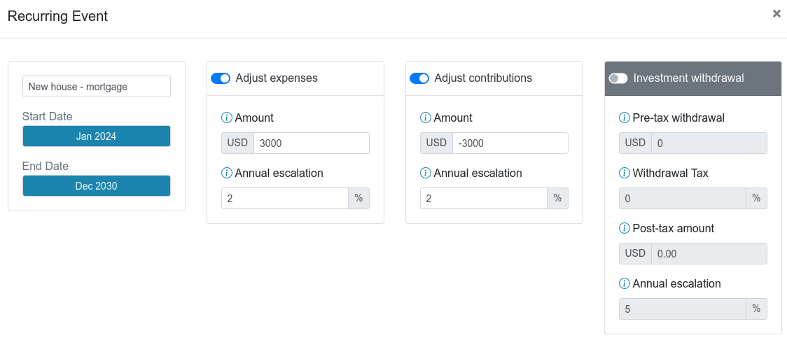

I might buy a house next year. How will those mortgage payments affect my FI journey?

I might have a child (or another child). How will those expenses impact my FI timeline?

Medical expenses increase as we get older. How will that change my FI plan?

Financial modelling

Model how real world factors impact your timeline to financial independence.