How to beat Warren Buffett in the stock market

When investing for retirement or financial independence, it's tempting to get caught up in stock picking. We all want to get the best returns possible on our money and find that hidden stock that's destined to increase one hundred fold.

But is picking winning stocks the only way to ensure a comfortable retirement?

Table of contents

Who is Warren Buffett

For those who don't know, Warren Buffet is one of the most successful investors of all time. In 2008 he became the richest man in the world (source: Forbes) and in other years consistently finds himself in the top 10.

Warren purchased his first shares in the stock market at age 11 and has since become somewhat of a celebrity in the world of investing as a result of his success spanning multiple decades.

It's generally agreed that Warren Buffet stands among the best investors on the planet.

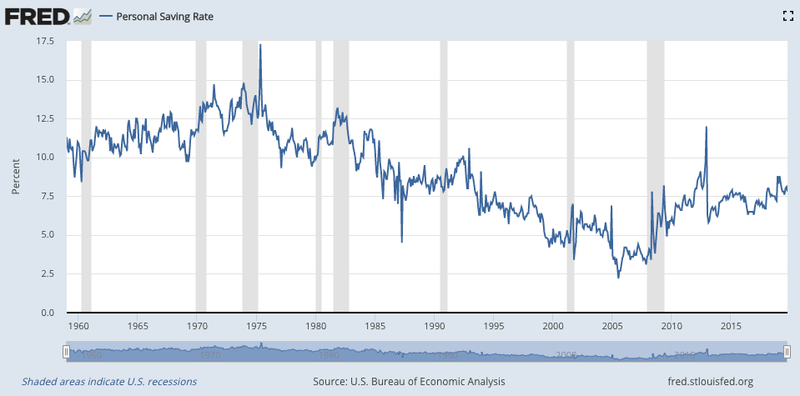

Before we step into the investing ring with Warren, let's take a look at some interesting stats about personal savings rates.

The scary truth

The current average personal savings rate in the US sits at 7.8%. That means 92.2% of people's salaries are spent every year. Those stats are similar across the globe with a few countries faring slightly better but many sitting at even lower savings rates.

It's hard to tell why people generally save so little of their income. We humans as a species tend to favour short term rewards over setting and achieving long term goals. That tendency may come into play when it comes to saving for retirement.

The scary thing about only saving 7.8% of our salary is that it will take 13 years to have saved up enough money to cover 1 year of expenses.

Let that sink in for a minute.

Financial Independence

Generally we think of retirement as some distant finish line we get to after having worked for 40-50 years at which point we hope that we have enough money saved up to live comfortably for our final years.

With the growing movement of financial independence, we're starting to learn that we can be free of needing to rely on our salaries far sooner than typical retirement age.

Financial independence doesn't necessarily mean that we stop working (although that's one option), it simply means that we no longer need to rely on a traditional salary to survive.

So how do we achieve financial independence? Do we need to beat Warren Buffet in the stock market to get there?

Not necessarily. Lets dig in...

Stock picking versus savings rate

Getting back to Warren Buffet who we've agreed is a rock star in the world of investing. Warren's long term return in the market has been 20% annually. He does this through exhaustive analysis of individual companies, industries, balance sheets and meetings with board members.

Lets look at two investors who we'll call Stock Picker Sam and Super Saver Sally.

Here's some facts about Stock Picker Sam:

- He earns $40 000 per year and receives a 4% increase on his salary each year.

- He invests 7.8% (the average in the US) of his salary every month.

- He tries to pick the best stocks which he believes will shoot the lights out in terms of performance.

- He's also a rock star stock picker like Warren and typically gets 20% annual return on his investments.

Projecting forward for the next 10 years, here's a look at his investments:

| Year | Salary (4% annual increase) | 7.8% of Salary | Cumulative Saving | Cumulative Saving at 20% Return |

|---|---|---|---|---|

| 1 | $40,000.00 | $3,120.00 | $3,120.00 | $3,744.00 |

| 2 | $41,600.00 | $3,244.80 | $6,364.80 | $8,386.56 |

| 3 | $43,264.00 | $3,374.59 | $9,739.39 | $14,113.38 |

| 4 | $44,994.56 | $3,509.58 | $13,248.97 | $21,147.55 |

| 5 | $46,794.34 | $3,649.96 | $16,898.93 | $29,757.01 |

| 6 | $48,666.12 | $3,795.96 | $20,694.88 | $40,263.56 |

| 7 | $50,612.76 | $3,947.80 | $24,642.68 | $53,053.63 |

| 8 | $52,637.27 | $4,105.71 | $28,748.39 | $68,591.20 |

| 9 | $54,742.76 | $4,269.94 | $33,018.32 | $87,433.36 |

| 10 | $56,932.47 | $4,440.73 | $37,459.05 | $110,248.92 |

Pretty impressive results thanks to Stock Picker Sam's phenomenal 20% annual return. He's ended up with $110,248.92 by only saving 7.8% of his salary.

Now lets take a look at Super Saver Sally:

- She also earns $40 000 per year and also receives a 4% increase on her salary each year.

- She avoids lifestyle creep and so she's able to invest 50% of her salary.

- She purchases broad market, diversified index tracking ETF's and doesn't worry about individual stocks.

- Her diversified index tracking portfolio returns 8% annually which is a reasonable long term average for the stock market. Sure, it's not shooting the lights out like Stock Picker Sam's portfolio but it's low maintenance and well diversified.

Projecting forward for the next 10 years, here's a look at her investments:

| Year | Salary (4% annual increase) | 50% of Salary | Cumulative Saving | Cumulative Saving at 8% Return |

|---|---|---|---|---|

| 1 | $40,000.00 | $20,000.00 | $20,000.00 | $21,600.00 |

| 2 | $41,600.00 | $20,800.00 | $40,800.00 | $45,792.00 |

| 3 | $43,264.00 | $21,632.00 | $62,432.00 | $72,817.92 |

| 4 | $44,994.56 | $22,497.28 | $84,929.28 | $102,940.42 |

| 5 | $46,794.34 | $23,397.17 | $108,326.45 | $136,444.59 |

| 6 | $48,666.12 | $24,333.06 | $132,659.51 | $173,639.86 |

| 7 | $50,612.76 | $25,306.38 | $157,965.89 | $214,861.94 |

| 8 | $52,637.27 | $26,318.64 | $184,284.53 | $260,475.03 |

| 9 | $54,742.76 | $27,371.38 | $211,655.91 | $310,874.12 |

| 10 | $56,932.47 | $28,466.24 | $240,122.14 | $366,487.58 |

After 10 years, Super Saver Sally has ended up with $366,487.56 which is more than three times what Stock Picker Sam ended up with.

What's important to keep in mind is that Super Saver Sally did this while getting less than half the percentage return on her investments (8% vs 20%) and by sticking to a low maintenance, diversified index tracking ETF portfolio.

The fastest route to financial independence

If you're hoping to one day retire or be financially independent, the best way to do that is to reduce your expenses and increase your savings. Whether you invest in the stock market, property or any other passive income generator isn't important. What's important is that you save as much as possible.

Sure it would be great to combine both a high savings rate and rock star level stock picking skills, but to be honest rock stars are called that for a reason. They've dedicated their lives to stock picking and yet the majority of the "professionals" still underperform the market average. There are only a hand full of Warren Buffett's in the world.

Keep those expenses low, be thrifty, save as much as possible and let the long term market averages do their thing.

Article by Brendon @ Money FI